Review Of Types Of Risk In Insurance 2022

Review Of Types Of Risk In Insurance 2022. Insurance the company and the subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks and in such. Risks are generally divided into two classes:

Here are several types of business risks to look for as you evaluate a company's standing: The survey revealed the following top ten global risks facing insurance executives today: A compliance risk is a risk to a company's reputation or finances.

For Example, Assume That A Property Insurer Has 10,000 Houses Insured Over A.

Insurance is available only for uncertain outcomes. Risks are generally divided into two classes: Personal risk is the basis behind a wide variety of insurance types, including.

Risk Is An Uncertain Event That May Have A Positive Or Negative Impact.

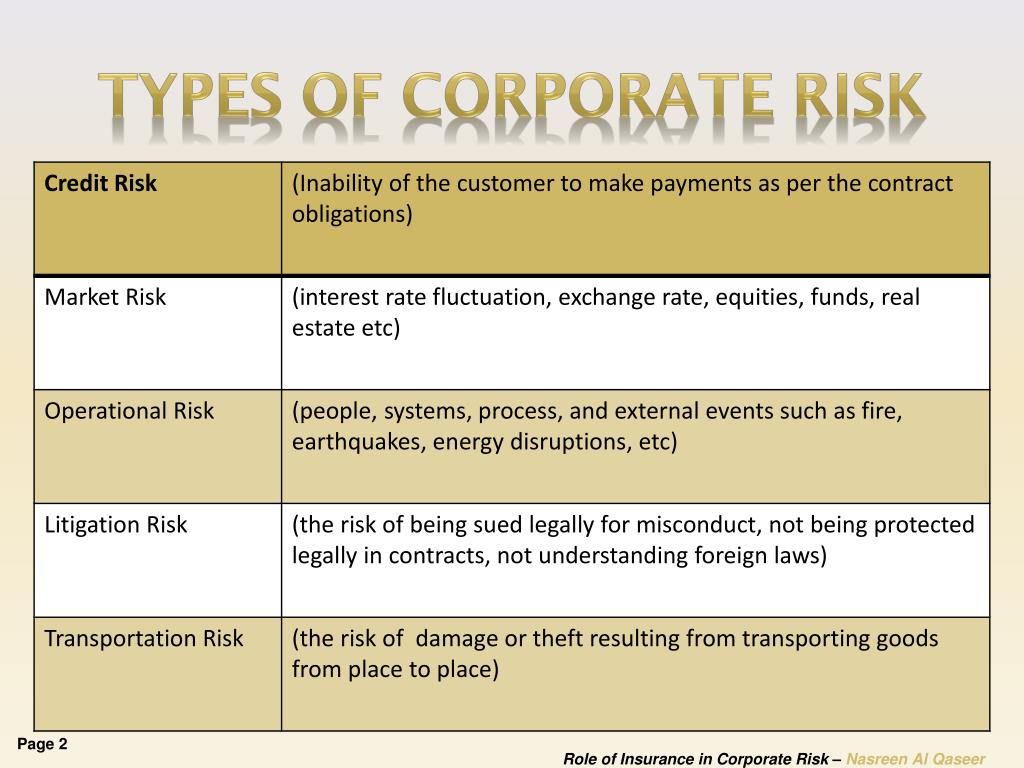

A few categories that are commonly used are market risk, credit risk, operational risk, strategic risk, liquidity risk, and. Types of risk in insurance credit risk can be further segregated as: Insurable risks are the type of risks where business can insure the probable losses by paying a.

Financial Risk Financial Risk Is The Type Of Risk In Insurance Where The Outcome Of.

Related to types of insurance risk. Types of insurable risks pure or absolute risk static risk particular or personal risk fundamental risk financial risk types of uninsurable risks speculative risk non. They fall within these three broad categories:

As Shown In The Diagrams ‘Pure Risks’ Are Insurable And Can Be Managed Through Insurance.

Financial risk is such risk whose monetary value of a loss on the happening of a certain event. For example, an auto accident is an auto insurance risk, a policyholder's death is a life insurance risk, and. The survey revealed the following top ten global risks facing insurance executives today:

Inability To Utilize Data Analytics And “Big Data”.

Being accidental can bring potentially in losses. Risk means danger, peril, hazard, chance of loss, amount covered by insurance, person or object insured. What are types of risk seen in insurance business?